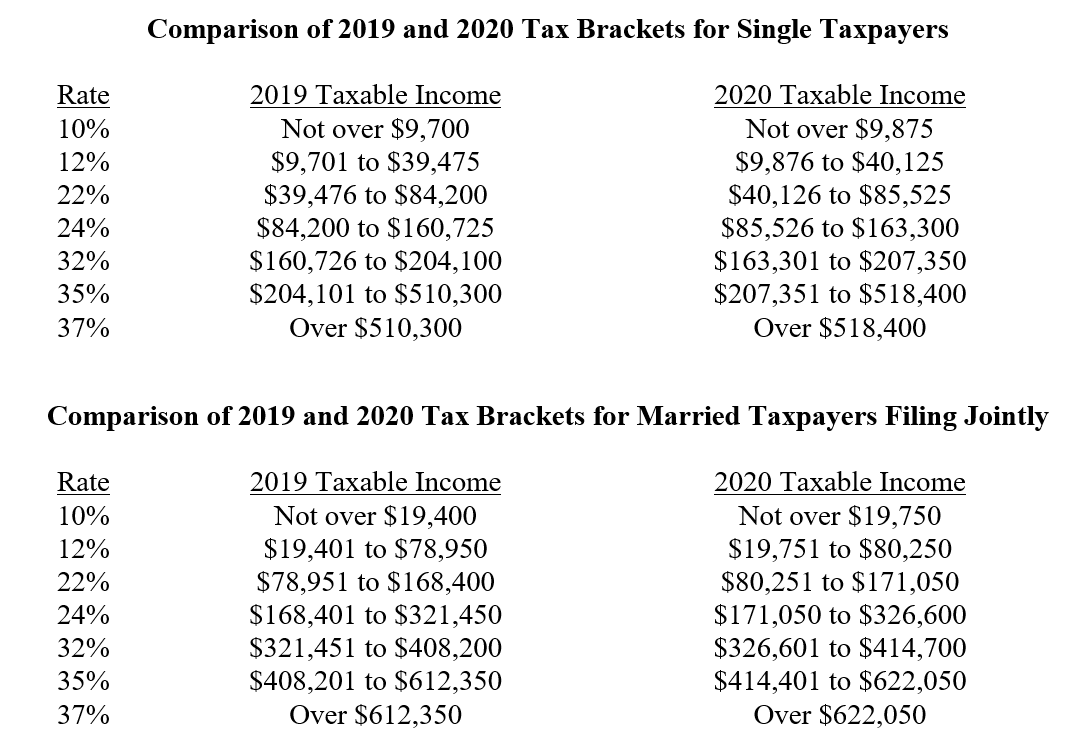

Here's a look at a few of the most popular: Some additional tax credits and deductions have been adjusted for 2020.

Charitable Donations. As a result of tax reform, the percentage limit for charitable cash donations to public charities increased from 50% to 60% in 2018 and will remain at 60% for 2o20.For more on mortgage interest under the TCJA, click here. Home Mortgage Interest. You may only deduct interest on acquisition indebtedness-your mortgage used to buy, build or improve your home-up to $750,000, or $375,000 for married taxpayers filing separately.

State and Local Taxes. Deductions for state and local sales, income, and property taxes remain in place and are limited to a combined total of $10,000, or $5,000 for married taxpayers filing separately.Medical and Dental Expenses. The “floor” for medical and dental expenses is 7.5% in 2020, which means you can only deduct those expenses which exceed 7.5% of your AGI.

There are changes to itemized deductions found on Schedule A, including:

0 kommentar(er)

0 kommentar(er)